Remittance Flow Design in Fintech – Verde Money Dashboard Case Study

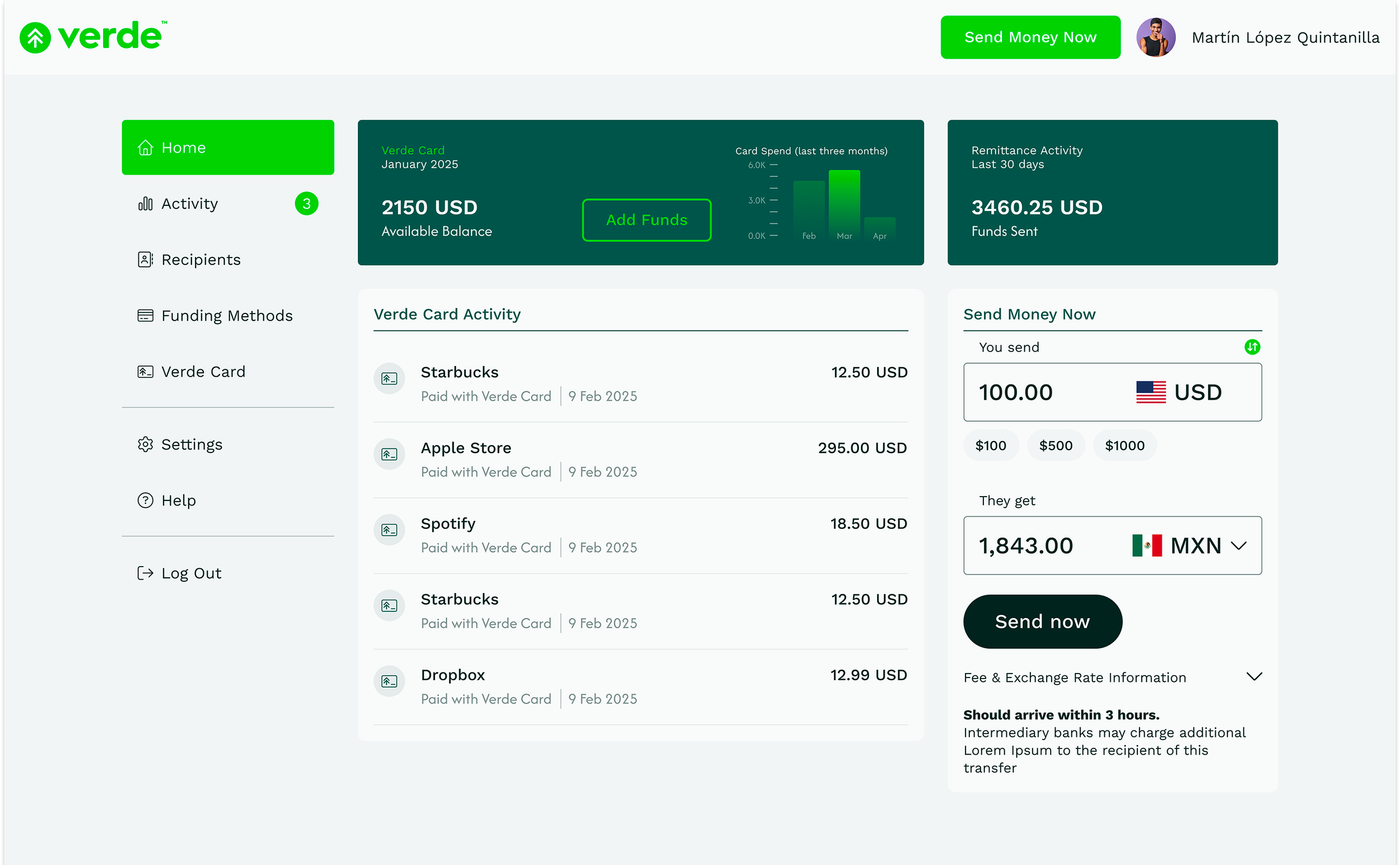

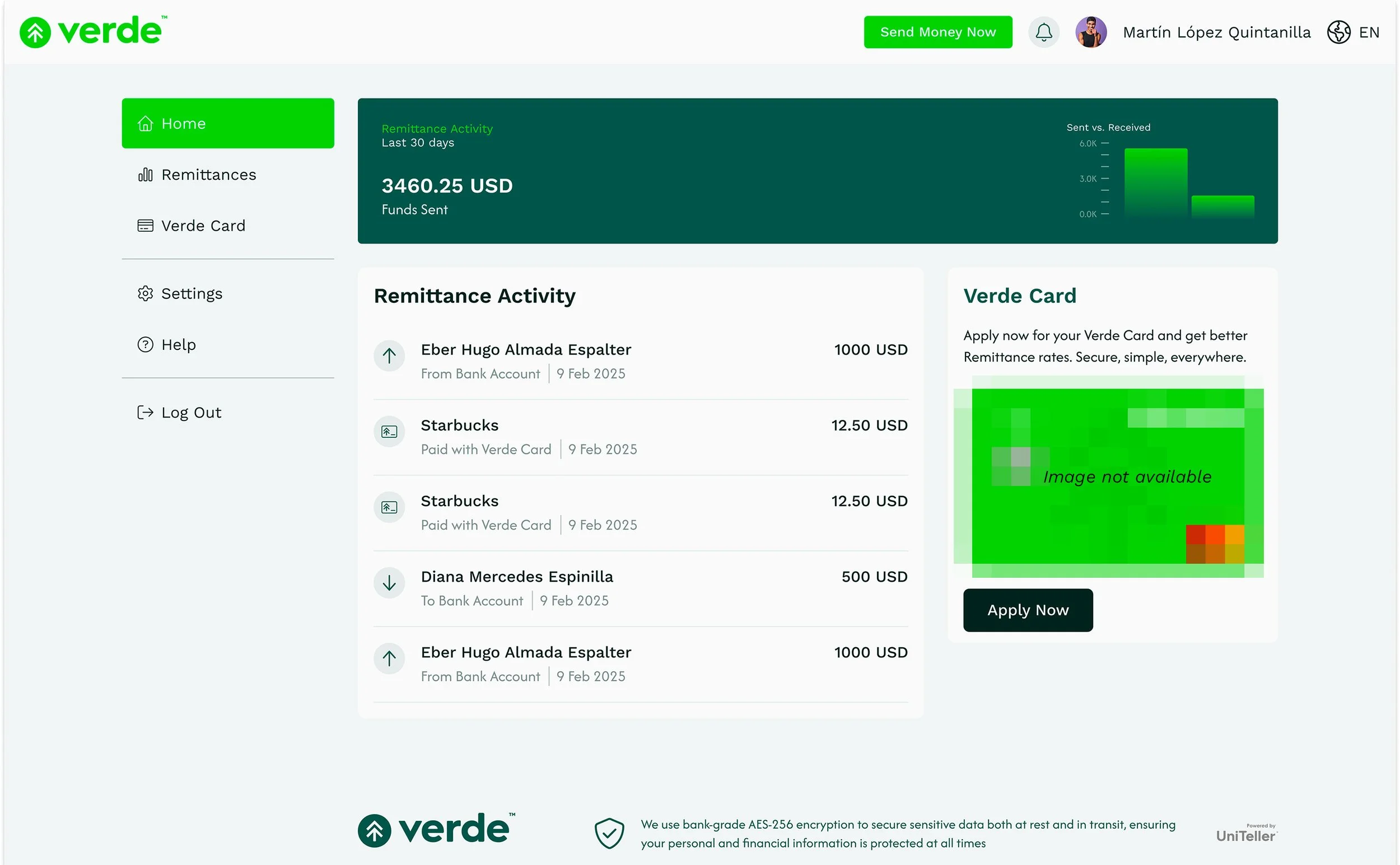

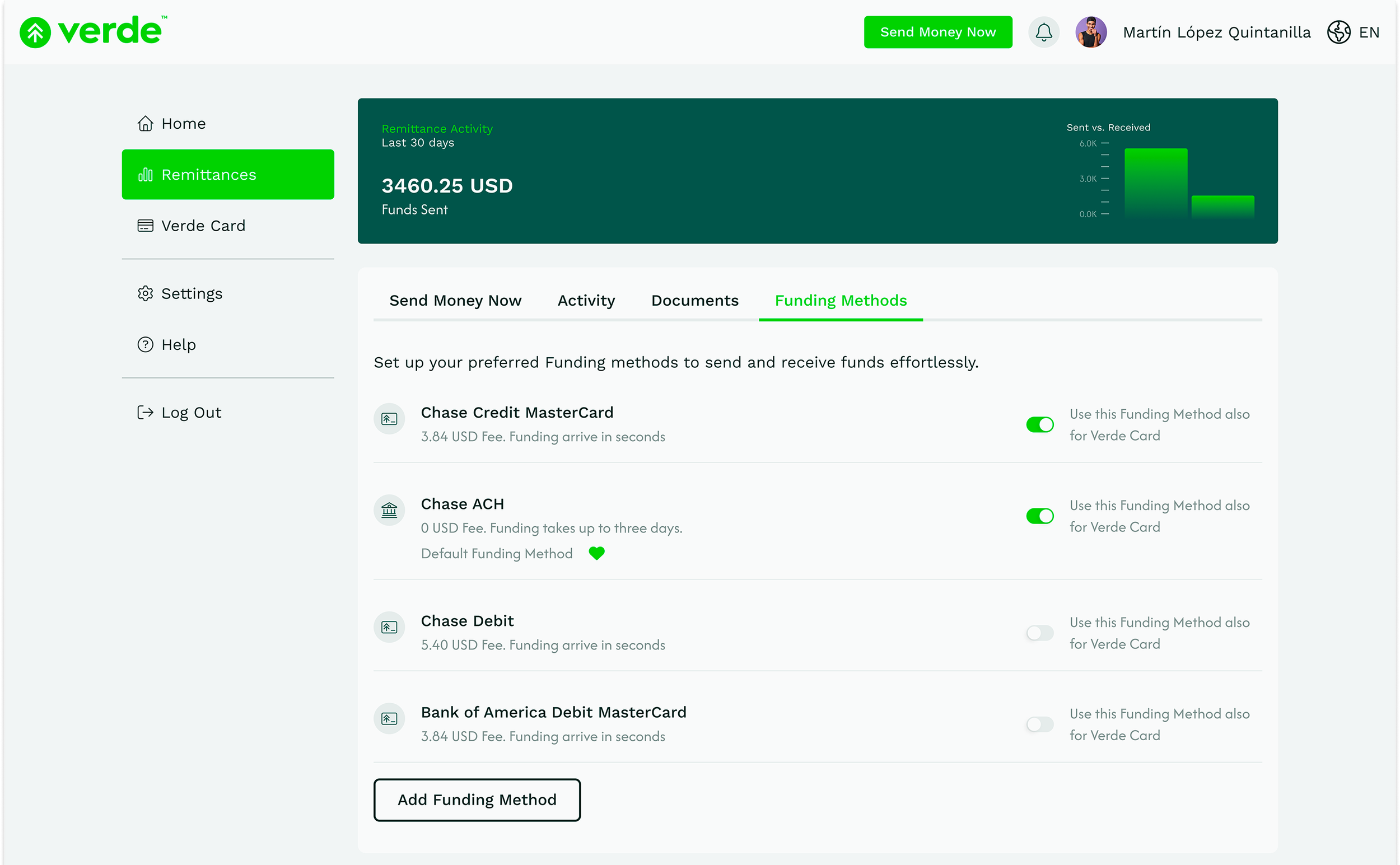

The Verde Money member dashboard was designed as the core product experience, enabling users to send money, manage payment methods, add recipients, and track transfers with ease. My focus was on creating a seamless and secure remittance flow that felt intuitive for both first-time and returning users.

The Challenge

The key challenge was to design flows that accommodated different user scenarios, such as adding a payment method or recipient either during or outside of the Send Money process. The experience also had to support a smooth onboarding for first-time transfers while ensuring trust, security, and compliance standards.

My Role & Responsibilities

As the only UX/UI designer, I was responsible for designing the complete dashboard experience, including all user flows for sending money. Beyond the remittance tool, I also conceptualized the upcoming credit card interface and mapped structures for other future services. My role was to design everything up until launch, after which Verde Money planned to transition to an in-house design team.

Design Process & Approach

I worked directly with partners and technology collaborators to bring the dashboard to life. The design process included several rounds of wireframes, prototypes, and polished high-resolution screens. I explored and iterated heavily on the Send Money flow, including first-time setup, adding recipients, and confirmation screens. The goal was to deliver an experience that balanced simplicity, trust, and security. The visuals presented here are Figma screenshots and may differ from the current product version.

In Short

Timeline: 2024-2025

Role: Sole UX/UI Designer

Tools: Figma

Skills: UX Design, UI Design, Interaction Design, Prototyping

About Verde Money

Verde Money is a modern remittance service designed to make sending money from the United States to Latin America fast, secure, and affordable—at just $2 per transfer. It offers transparent, competitive exchange rates and allows recipients to receive funds directly into their bank account or pick them up in cash through a network of over 90,000 trusted locations across Latin America. The platform prioritizes user convenience with multilingual support (English, Spanish, Portuguese), robust bank-level encryption, and multi-factor authentication—ensuring both peace of mind and seamless accessibility around the clock.

Mission & Smart Pricing Philosophy

At its core, Verde Money embodies a mission of financial inclusion and empowerment. Founded on the belief that financial success should be within everyone’s reach, it offers intuitive, culturally informed tools built by a team that often shares the lived experiences of its users. Their smart pricing model avoids hidden fees by cutting out legacy banking intermediaries and inefficiencies—delivering premium service at reduced cost. The platform’s emphasis on transparency, direct reinvestment in user experience, and trust reflects a commitment to serving immigrant communities with dignity and accessibility.